Lawmakers Propose Auto AM Radio Bill

May 23, 2023A group of U.S. senators introduced the AM for Every Vehicle Act, which is bipartisan legislation that would direct federal regulators to require automakers to maintain AM broadcast radio in new vehicles at no additional charge. The legislation follows from the letter that Democratic Sen. Ed Markey sent to 20 of the world’s leading carmakers last year requesting that they maintain access to AM broadcast radio in their vehicles. Of the 20 carmakers, eight had removed AM broadcast radio from their electric vehicles.

Specifically, the AM for Every Vehicle Act would:

- Direct the National Highway Traffic Safety Administration (NHTSA) to issue a rule that requires automakers to maintain AM broadcast radio in their vehicles without a separate or additional payment, fee, or surcharge;

- Require any automaker that sells vehicles without access to AM broadcast radio before the effective date of the NHTSA regulation to clearly disclose to consumers that the vehicle lacks access to AM broadcast radio;

- Direct the Government Accountability Office (GAO) to study whether alternative communication systems could fully replicate the reach and effectiveness of AM broadcast radio for alerting the public to emergencies.

“For decades, free AM broadcast radio has been an essential tool in emergencies, a crucial part of our diverse media ecosystem, and an irreplaceable source for news, weather, sports, and entertainment for tens of millions of listeners,” said Markey. “Carmakers shouldn’t tune out AM radio in new vehicles or put it behind a costly digital paywall.”

Hyundai, Kia Settle Class Action for $200 Million

May 22, 2023Owners of cars that lack immobilizing anti-theft devices have agreed to resolve a class action litigation with Hyundai and Kia. The agreement could be valued at approximately $200 million, depending on how many customers elect to participate. Owners of the vehicles, which do not have push-button ignitions, will receive cash compensation if they incurred theft-related vehicle losses or damage not covered by insurance, in addition to money for insurance deductibles, increased insurance premiums, and other theft-related losses.

"We appreciate the opportunity to provide additional support for our owners who have been impacted by increasing and persistent criminal activity targeting our vehicles," said Jason Erb, chief legal officer, Hyundai Motor North America. "Customer security remains a top priority, and we're committed to continuing software upgrade installations and steering wheel lock distribution to help prevent thefts and offering insurance options through AAA for those who have had difficulty securing and sustaining coverage."

John Yoon, chief legal officer, Kia America, said Kia is pleased that consumers will receive additional benefits through this settlement. "This agreement is the latest step in a series of important actions, in addition to providing a free security software upgrade and distributing over 65,000 steering wheel locks, that Kia has taken to help customers whose vehicles have been targeted by criminals using methods of theft popularized on social media,” he said.

As part of this settlement, the software upgrade will be automatically installed in conjunction with any service or maintenance appointment that brings the owner of an eligible vehicle into the dealership.

For the subset of customers whose vehicles cannot accommodate the software upgrade, the agreement will provide reimbursement up to $300 for the purchase of various anti-theft devices. Hyundai and Kia have also provided consumers with tens of thousands of free steering wheel locks, either through local law enforcement or through direct shipment to impacted owners.

The settlement includes approximately 9 million Hyundai and Kia vehicles.

Colorado Senate Passes Car Theft Bill

May 17, 2023Current law criminalizes auto theft as “aggravated motor vehicle theft in the first degree” and “aggravated motor vehicle theft in the second degree.” The penalties for both aggravated motor vehicle thefts are based on the value of the vehicle or vehicles stolen.

A new bill changes the term of the offense “aggravated motor vehicle theft” to “motor vehicle theft.” The elements for motor vehicle theft in the first degree and second degree are changed and motor vehicle theft in the third degree is created. The penalties for motor vehicle theft are no longer based on the value of the vehicle or vehicles stolen. Motor vehicle theft in the first degree is a class 3 felony, motor vehicle theft in the second degree is a class 4 felony, and motor vehicle theft in the third degree is a class 5 felony.

The bill creates the offense “unauthorized use of a motor vehicle” and makes it a class 1 misdemeanor, or a class 5 felony for a second or subsequent offense.

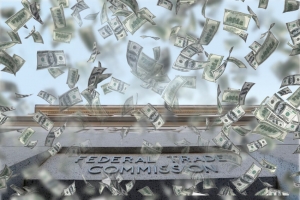

The Federal Trade Commission is sending payments totaling more than $3.3 million to customers of Passport Auto, a Washington D.C.-area auto dealer. In October 2022, the FTC charged Passport with adding hundreds, or even thousands, of dollars in illegal junk fees to car prices and for discriminating against Black and Latino consumers by charging them higher fees and financing costs.

The FTC is sending checks to more than 18,000 consumers. Recipients should cash their checks within 90 days, as indicated on the check. Consumers who have questions about their payment should contact the refund administrator, Epiq, at 877-701-3692, or visit the FTC website to view frequently asked questions about the refund process. The Commission never requires people to pay money or provide account information to get a refund.

The FTC’s suit against Passport Auto, its president, Everett Hellmuth, and its vice president, Jay Klein, charged that the defendants’ junk fees caused consumers to pay more than the advertised price or lose any discounts they had negotiated.

The Commission’s interactive dashboards for refund data provide a state-by-state breakdown of refunds in FTC cases. In 2022, Commission actions led to more than $392 million in refunds to consumers across the country.

Supply Crunch Challenges Fleet

May 16, 2023LAS VEGAS – Top remarketers discussed the challenge of the continued supply crunch during a panel discussion here at the Conference of Automotive Remarketers this spring.

Panelists included Wheels’ Mary Beth Greenstone, vice president of operations, remarketing & title service at Wheels; Jeff Krogen, vice president of fleet strategy of Enterprise Fleet Management; Holly Vollant, vehicle remarketing for Holman; and Matthew Gast, head of remarketing for Mike Albert Fleet Solutions. They joined moderator Mike Antich, who described the group as representing probably close to 60% of off-lease commercial fleet vehicles.

The initial comments focused on the strong results remarketers were getting in a low-supply market. “What we’re seeing is the pricing – as far as sedans and small SUVs – are strong,” Greenstone said. During COVID, it was hard to find a commercial van since people who were out of jobs acquired vans to start their own businesses, Greenstone said.“You see them coming back, but with a whole lot of miles,” she said. The mix of the market is still very strong and clients are happy about the money Wheels is bringing on the remarketing side, Greenstone said. “Sedans seem to be doing well on the retention we’re getting back from auctions on those vehicles just because fewer of those are being made,” she said.

Gast said Mike Albert Fleet Solutions is seeing fewer and fewer new vehicles delivered, leaving fewer used vehicles to remarket. “But for the used-car marketplace, it continues to be better than expected,” he said. Vollant said there was still a lot of nervousness at the beginning of the quarter, not knowing what to expect. “But it felt like a March in the car business,” she said. “Values were high and conversions were high. We continued to see those retentions across the board.” Vollant said talking with her clients to understand how their businesses have changed is critical. “Their fleets look different than they did three years ago,” she said. The commercial remarketing side has been very strong for Enterprise Fleet, as well as upfit type vehicles. “Cargo vans have been crazy,” Krogen said. “I know they’re a little off now, but they’re still bringing amazing money. We’re also doing well with ¾ ton heavy duty-type trucks. If we get low-mile stuff, our other clients want those, so we’re able to repurpose those to other clients. “It’s been a great market for remarketers. It makes your life a lot easier.”

The issue of age and mileage for remarketers seems to be the new way of life in the foreseeable future. “Obviously, the low volume we’re seeing out of the OEMs to man our fleet (is a challenge),” Greenstone said. “We’ll try to order 1,000 cars for a client and they tell us you can only have 200. "We have to come up with a source for our clients when their cars start aging and the mileage starts increasing. Just the cost of keeping those cars on the road for our clients is difficult.”

Clients are not turning cars in. They are refurbishing them and putting them back into service, Greenstone said. “It’s been a struggle, so with the cars coming back over the next couple of years, we’re just going to see a much higher mileage and more wear and tear,” she said. With these supply issues, the rebates are available less often and fleet customers end up paying almost MSRP. “Setting those residuals is difficult as well so that we make sure they don’t end up upside down for the time they come back to remarket,” Greenstone said

Gast said Mike Albert Fleet Solutions has spent a lot more time consulting with its clients trying to find vehicles. “Clients who used to order 500 to 1,000 vehicles per year are now being allocated with 75 from a manufacturer,” he said. “It leads you to scurry for them. They look to us and ask, ‘what can we do’ and we don’t have the right answer because all the manufacturers are in the same boat, trying to fulfil the needs are all their other clients. It’s been a big struggle.” Krogen, however, said he’s seen an average of 5,000 less miles on return to service vehicles as some of his clients have been open to cycling their vehicles.

With reconditioning and down times rising, cars are being kept about five months longer than in the past, which isn’t too bad, Grogan said. “But there’s probably a tsunami of high-mileage vehicles coming,” he said. Krogen said with small cargo vans going away, his company is trying to come up with different ideas to keep clients happy. “(It could be a) little hatchback if the client doesn’t need a lot of space, or a pickup with a cap and slide-outs and bins,” Krogen said. “It’ll be interesting to see how the market (reacts) to those when they come back in three or four years.” Gast agreed that clients are re-evaluating their specific needs in the current market because of the shortage of vans.

Over the next three to five years, it will be different from the days of getting a base cargo van. The provider will need to find a vehicle from dealer stock so it will be a much more well-equipped vehicle, not a typical fleet. Krogen added that manufacturers are making vehicles available with higher specs, which change franchise dealer habits when fleet vehicles return from service. He said these higher equipped vehicles may draw more franchise dealers in, broadening the base of buyers for remarketers, Krogen said. “The independents are great, too,” he said. “We sell a ton of cars to independents.”

Greenstone said the need for cars forces companies to look everywhere. “We’re looking at every available source,” she said. “When there’s plenty of inventory out there, it’s easy and we don’t’ tend to look at those non-conventional places.” But fleet providers have been forced to do that in the current market.Fleet providers have been forced to keep vehicles in service longer, adding mileage and raising concerns about service and problems of downtime while vehicles are in service.

The trend now is fleet preservation.When shortages become expected, Enterprise Fleet began ordering as many cars as they could. But they would also have to run cars longer. “Maintenance was key,” he said. “Any of our clients who were not on a maintenance program, we wanted to make sure they thought about it, at least.”

“The problem is when vehicles get older, they get exponentially rougher and drivers don’t care about them as much,” Krogen said. “The first dent you notice, the 45th dent, you don’t.”

Repairs are also a problem. “Downtime has been brutal,” Krogen said. “I mean it can take weeks and weeks to get parts, as you know.” Gast added it’s also about re-evaluating the preservation strategy. “More and more clients are signing up for service and more and more clients are asking for that proactively,” Gast said. Greenstone said Wheels’ repair department is becoming very innovative with artificial intelligence (AI). “Wheels is also communicating more with drivers on a mobile app, making it easier for customers to get service.”